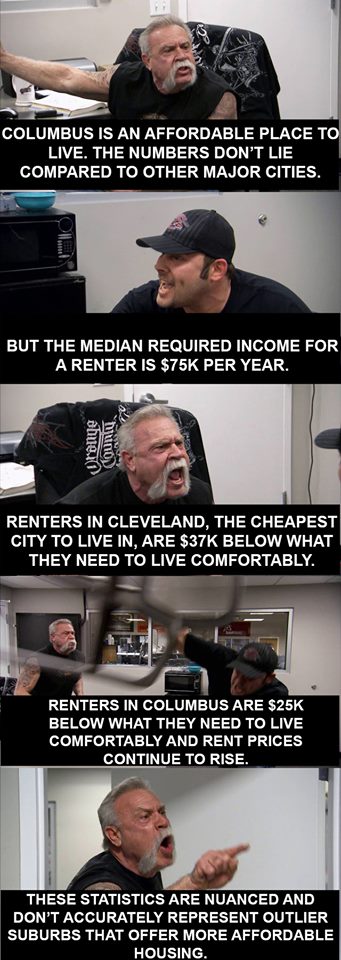

614 Meme: Study shows “Columbus is an affordable place to live”

An article from Columbus Business First reported that according to GOBankingRates, Columbus is a relatively affordable place to live stacked up against other cities.

In the report, the findings show the median income in Columbus is $49,478. The report also looked into the required income needed to be a homeowner and renter in each of the 50 cities. In Columbus, homeowners are said to need an income of $68,775 to afford to live comfortably, while renters need an income of $75,063. The gap between median income and required income for homeowners is $19,277. Renters see that price go higher as they are looking at a $25,585 gap.

In comparison, Cleveland—the cheapest city to live in among the 50 larges cities—checked in at $27,854. Other cities like San Jose, California topped out at $96,662.

Also to compare, Dallas, Texas has a median income slightly less than Columbus at $47,285. However, homeowners in Dallas are facing a required income of $83,140, while renters need an income of $87,964. The gap between median income and required income for homeowners in Dallas is $35,855. Again, that price goes higher for renters as their gap jumps to $40,679.

BROUGHT TO YOU BY

Though Cleveland is the cheapest place to live of the 50 major cities, it’s gap for median income and required income for renters isn’t far off from Dallas. The required income for renters in Cleveland is $64,883 making a $37,029 gap.

The study’s findings were based off the 50/30/20 rule which says 50% of your income goes to necessities, 30% into splurges and fun, and 20% into savings.

“And it’s true: How much money you need to live comfortably is just much higher in the big city, putting the 50/30/20 rule out of reach for most of its residents. That’s why a new GOBankingRates study lays out just how much you need to earn to live comfortably in each of America’s 50 largest metropolises based on the cost of living by city. Using Zillow to calculate housing costs in each locale and Sperling’s Best Places to estimate the price of other necessities like transportation, groceries and healthcare, the end result is a clear sense of just how much you would need to be bringing in to stick to the 50/30/20 rule at average levels of spending in each category.” —Joel Anderson, GOBankingRates

BROUGHT TO YOU BY